Public trust and cryptocurrencies

21 February 2018

Bitcoin and other cryptocurrencies have recently been subject to severe attacks from the official sector denouncing them as a “bubble” and “Ponzi” scheme. Mark Carney, governor of the Bank of England, said on 19 February that bitcoin has failed as a currency amid its extreme volatility.1 The G20 is now called upon to offer some comprehensive regulation. Volatility though may be a poor guide to assess currencies.

Agustín Carstens, General Manager of the Bank for International Settlements recently pronounced that “the meteoric rise of cryptocurrencies should not make us forget the important role central banks play as stewards of public trust. Private digital tokens masquerading as currencies must not subvert this trust.”2

The G20 will meet this year in Argentina. There could be no more fitting place to assess central banks as stewards of public trust. Argentina whose currency the peso or its previous incarnation the austral, has been lost multiple times over during the past few decades to hyperinflation and devaluations, offers a splendid backdrop to discuss performance of government-issued currencies.

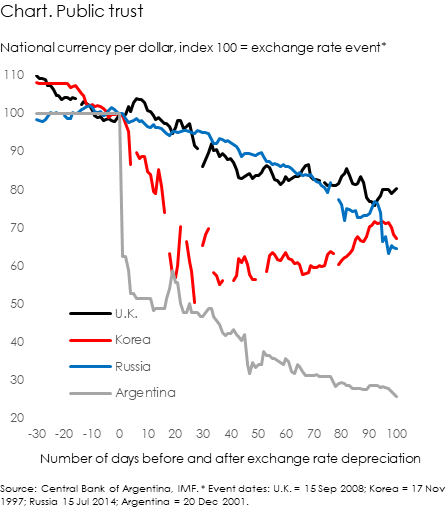

There are few areas where public trust has been abused more than in money. For example, during the 100 days since 15 September 2008, the day Lehman Brothers collapsed, the British pound lost 28 percent against the U.S. dollar; since 15 July 2014, after oil prices started to fall, the Russian rouble lost 37 percent; since 17 November 1997, when the Bank of Korea stopped supporting the won during the Asia crisis, the Korean won lost 50 percent; and since 20 December 2001, when Argentina abandoned the convertibility plan, the Argentine peso lost 74 percent (Chart).

The “inherent weaknesses of the trust based model” is what Satoshi Nakamoto, the pseudonym inventor of bitcoin, wanted to overcome with a peer-to-peer based system.3 Clearly, the notion of trust must differ between countries and is highly contingent on actual monetary experiences. Generalisations about public trust are therefore tricky. As with dollarization, cryptocurrency adoption will be driven largely by discontent about national currencies. It also means that the distribution of the perceived risks and benefits are likely to be highly asymmetrical.

Cryptocurrencies have reinvigorated interest in and debate about notion and meaning of money. It may to date have been their greatest contribution. They brought back an older debate questioning the monopoly of government in the production of money.

Sharp fluctuations in exchange rates are indications that public trust in central banks is wobbly. Yet to put greater trust in cryptocurrencies than in national currencies may still appear to many as fanciful. It raises the question though of the barriers to substituting national currencies. Those may be lower than some central bankers wish. In that case, a more prominent role of cryptocurrencies may not be fanciful at all. In Argentina, few may regret that.