Is the dollar still international enough?

Conference—World Finance Forum

Center for BRICS and Global Governance and Reinventing Bretton Woods Committee

Beijing, 30 June 2018

Ladies and Gentlemen,

I'm most grateful to the organisers for inviting me to this timely and most topical conference. In my brief remarks, I would like to explore the nexus between uncertainty and the direction of the international monetary system to address the question: Is the dollar still international enough to serve the international economy? As you know, the dollar remains by far the dominant international currency and a great number of countries, including China, maintain monetary policy frameworks that rely on the dollar as anchor currency. New financial technologies may now allow to overcome the entrenched advantages of the dollar. Decentralisation may be the new approach to integration.

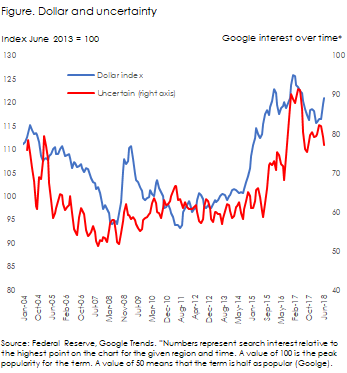

Uncertainty, as in the title of this opening session, is on the rise. The dollar itself seems an expression of that uncertainty. The close positive correlation between the dollar index and the interest over time of the Google search term “uncertain” supports the notion that uncertainty has been increasing and that this among other things may have given rise to an appreciation of the dollar amid its safe haven currency status. It highlights the dollar dependence of the international economy (Figure).

The dollar is playing a critical role for international exchange and investments. Yet, it is a national currency and the Federal Reserve uses the dollar to address national policies. When there is convergence between national and international interests, there is no problem. When there is divergence, the Federal Reserve will not subordinate its national policy objectives to the needs of the international economy. The recent strength of the dollar has brought pressure in particular onto emerging markets currencies that risks giving rising to renewed economic instabilities.

Persistent dollar dependence and rising uncertainty has been accompanied by a perceived weakening of multilateralism. The U.S. seems to be demonstrably undermining the multilateral system amid a looming trade war, its withdrawal from the Paris Climate Accord, its attitude at the last G7 summit in Canada. Its actions signal that there is less willingness to pursue a consensual approach in international affairs. A nationalist U.S. seems incompatible with the international role of the dollar.

The weakening of the multilateral system is by no means due alone to the U.S. Persistent high exchange rate volatility and large external payments imbalances for some time illustrate a generalised lack of international policy coordination. Brexit echoes new nationalist attitudes. The possible establishment of a European Monetary Fund also highlights preference towards regional arrangements.

The difficulties of an international monetary system that relies on a national currency are well known. The Triffin Dilemma to highlight the inherent conflict between national and international liquidity needs emerged during the 1960s. Not much progress has been made since.

The dollar emerged as the dominant international currency after World War II with the adoption of the Bretton Woods system of fixed exchange rates. The Bretton Woods Agreement of July 1944 with the establishment of the International Monetary Fund (IMF) was a unique undertaking where countries agreed for the first time by international treaty to give up their ability to manipulate exchange rates unilaterally. China of course played a very active role in the discussions at Bretton Woods.

Bretton Woods was part of a different spirit. The U.S. had a vision at the time of a grand design for stability, security and peace after World War II. based on an approach that was fundamentally multilateral with a leading role for the U.S. The original distribution of quotas at the IMF, the quasi capital shares to set financial contributions and voting power, provided by far the largest quotas to the U.S., U.K., Soviet Union and China or two thirds of the total with the aim to instil and achieve shared responsibilities.

The original architecture envisaged at Bretton Woods was built around multiple currencies. The Joint Agreement of April 1944 and the working documents finalised at Atlantic City in June 1944 made no special reference to the dollar. The change in the final version of the Articles of Agreement at Bretton Woods to enshrine the dollar as the anchor currency in Article IV came only late during the negotiations and the origin of the change remains obscure. The working assumption was that the resumption of currency convertibility planned for shortly after World War II would allow to use a number of different currencies for the operations of the IMF. The system was never meant to rely solely on the dollar. But it did.

Financial technology may now allow overcoming the advantages of the dollar. The dollar thrives because the U.S. offers the biggest and most liquid financial markets, large financial institutions, that have produced an infrastructure for international exchange, making the dollar the most accepted currency internationally. These network effects are hard to compete with for invoicing, liquidity, clearing, settlement and payments. However, fintech may now allow to offer new advantages that depend less on economies of scale but more on technology. A fintech-driven paradigm shift where market liquidity can be replaced with smart algorithms, speed and ease of settlement to trump scale and conventional currency management advantages. While the dollar is likely to remain the most important currency, it would allow smaller currencies to play a greater role in the international economy and make the international monetary system more multipolar.

Money has seen few radical changes since the proliferation of paper currencies and the introduction of cashless payments with the giro system during the 19th century. While the adoption of fiat currencies and floating exchange rates in the 1970s represented a major shift, the technology of money as a medium of exchange has not changed much. Technology may now offer a new approach. Blockchain-based technologies provide a decentralised way to manage international payments that will be able to rely on decentralised currencies.

To conclude, I would like to leave you with the idea that decentralisation may be the new approach to integration. New technological solutions for money may help overcome prevailing constraints. The international monetary system may now become what it meant to be from the beginning, namely a pluralistic system where responsibilities and benefits are more evenly distributed. Scope and need for change has been there for some time. Fintech offers the possibility for change now.