Central bank digital currencies and a new currency architecture

LSE Institute of Global Affairs and Financial Markets Group Conference—Financial resilience and systemic risk

Session—New central banking instruments including digital currencies

London, 31 January 2019

Ladies and Gentlemen,

It is my great pleasure to present to you here today and I'm most grateful to the organisers for the invitation. My current work is about the adoption of central bank digital currencies and blockchain-enabled payments solutions and how those are set to change finance and international monetary relations. It is therefore of particular interest to me to speak to the topic of the session. In my brief remarks, I shall first highlight the case for new currencies. I shall then focus on blockchain-enabled digital currencies issued by central banks. I consider blockchain-based technologies to offer new properties critical to ensuring central bank currencies remain future-proof while laying the foundations for a new currency architecture.

To start, I will aim to dispel two erroneous premises in the discussion about digital currencies. First, that only central banks can offer stable currencies; second, that private currencies cannot serve a useful role.

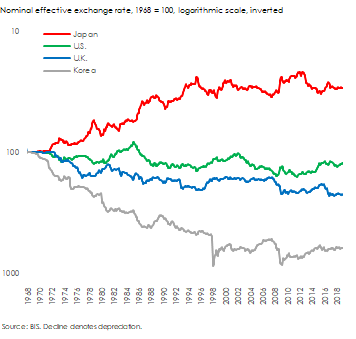

The notion that central banks produce stable currencies is evidently false. While there are several central banks that have a robust record of currency stability, most do not. Monetary history is a troubled one in particular during the last 50 years. Most currencies suffered significant depreciations. Sterling is worth significantly less than half its value of the early 1970s in effective exchange rate terms. Most emerging markets currencies today on that basis retain only a small fraction of the values they had during the past decades (Figure 1).

There is a gap in currency needs. The dollar continues to be the dominant international currency. But it serves the needs of the U.S. The Federal Reserve will not subordinate its policy objectives to those of the rest of the world. This can pose a problem where national and international needs diverge. The Triffin dilemma has long enunciated that the use of national currencies in international transactions is problematic.

Figure 1. Currency instability

Private currencies or crypto-assets have recently gotten a bad press. Yet, most goods and services are privately produced. Most monies are also liabilities of private banks. Private currencies, in theory though not in practice, should be as adequate a good as other private goods. They could e.g. serve large international commercial networks. Crypto-assets issued by Alibaba, Amazon or Google with hundreds of millions of users would constitute ecosystems far bigger than many countries. Strong brand recognition and consumer confidence in their services may make it feasible to entice users to accept their currencies for purchases and payments.

Private currencies have a long though not always glamorous history. Many paper currencies or bank notes through the nineteenth century were private and emerged to satisfy new payments needs. Coins like the Maria Theresa thaler were minted and issued through the twentieth century privately to serve international trade.

Stability is of course critical to currency adoption. It is why many central banks choose an external anchor to borrow the stability of others. Private currencies are doing it too. The emergence of stable coins, why still only very marginal though fast growing, is indicative of the desire to hold stable digital currencies.

This is to say that central bank currencies may well face greater competition. Those that have had a poor track record will be more vulnerable, also those whose currencies may not be well suited for international transactions. Competition may be most severe from central bank being early adopters of digital currencies.

Blockchain-enabled central bank digital currencies are set to enhance what central bank currencies can do. It is not so much about substituting one medium for another but to enhance currency properties to make them more adaptable to new emerging payment needs, improve user experience and functionality. Blockchain is part of a broader vision of adopting tokenisation of all assets and currencies.

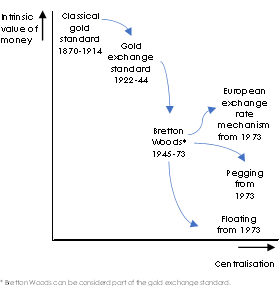

Blockchain confers a different approach to the organisation of money. Money evolved from exhibiting high intrinsic value and being highly decentralised to representing no intrinsic value and being highly centralised. The value of money shifted from money itself to the institutions managing it.

Currencies throughout the nineteenth century were mostly specie-based. The intrinsic value of the currencies and commitment by central banks to uphold convertibility into specie established a monetary system with strong decentralised elements in central banking. With time the intrinsic value of currencies declined while the production and organisation of money became increasingly more centralised. This continued with the adoption of the gold exchange standard after World War I and subsequently with the establishment of the Bretton Woods system after World War II. Centralisation evolved further with the introduction of free floating when the intrinsic value of currencies ceased. Today's system of complete centralisation accompanied by large financial institutions and financial market infrastructures poses new problems. Blockchain offers the opportunity to restore a more decentralised system based on the enhanced properties of money that convey greater intrinsic value. It may provide a new way for organising money itself (Figure 2).

Figure 2. Money and centralisation

The advantages of blockchain-enabled currencies rest in the combination of tokenisation, decentralisation and secure information sharing. If all assets and currencies were on ledger or tokenised, instantaneous delivery versus payment and peer-to-peer transactions would be possible. This would significantly reduce clearing and settlement times, transaction costs and make large value payments more accessible and benefits thereof more equitable in national but in particular in international transactions. Tokenisation and decentralisation would also allow to inject or withdraw liquidity directly with holders of central bank currencies or pay positive and negative interest. The decentralised nature of blockchain implies that payment infrastructures would be more secure and resilient to failures and cyberattacks. Blockchain allows far more effective secure information sharing than conventional technologies facilitating better monitoring of liquidity and financial transactions.

Use cases for blockchain-enabled central bank digital currency and payment applications are numerous. In retail, blockchain-enabled currencies can foster financial inclusion and facilitate remittances payments, in wholesale they can render securities trading more efficient and accessible, in cross-border transactions, they can reduce reliance on correspondent banks.

Recent developments in blockchain have shown that blockchain can meet and exceed the performance of conventional payment technologies. It also implies that earlier concerns about scalability, privacy and inter-operability have been increasingly addressed.

To conclude, there seems to be a natural role for private currencies. Central bank currencies are no longer the only game in town. While fierce new competition may not be around the corner just yet, digitalisation allows currencies to assume new functionalities. Blockchain-enabled digital currencies would offer central banks new tools to influence the demand for central bank currencies beyond the traditional monetary policy transmission mechanisms and address key use cases. This could change the propensity to hold currencies both by residents and non-residents. It would make central bank currencies more adaptable and make payments more accessible, resilient and equitable. Financial technology may thus be the new driver towards a new currency architecture.