IMF borrowing in renminbi

2 April 2020

The International Monetary Fund (IMF) has not nearly enough resources. With a residual lending capacity of about US$800 billion (less than 1 percent of world GDP), the Fund will struggle to be a credible back-stop in the impending covid-19-induced international crisis. Borrowing is the only way the IMF can increase resources fast. China is not helping the IMF much at the moment and could offer the Fund to create a renminbi facility. It would affirm China's economic heft and the designation of the renminbi as a freely usable currency. It would help advance needed diversification of international liquidity.

The IMF's lack of resources has long been acknowledged. In a recent press statement, the IMF outlined that increased commitments are needed "as the whole world fights Covid-19 and demand for IMF resources is high […] so that the IMF can continue to play its essential role as a lender of last resort at this time of crisis."

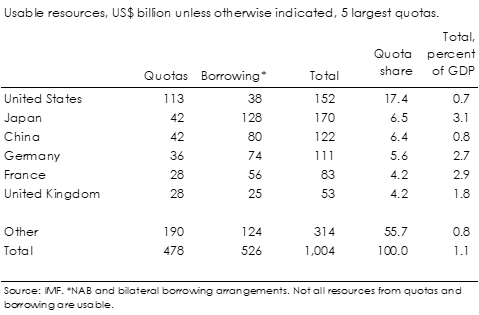

The IMF has total usable financial resources of about US$1,000 billion including quota resources and borrowing arrangements. Usable quota resources are US$480 billion. Quotas are the IMF's own resources representing the financial contributions countries are obliged to make and should broadly reflect a country's position in the world economy. They also determine countries' voting power in IMF decisions. Borrowing arrangements represent additional temporary resources comprising in terms of usable funds the multilateral new borrowing arrangements (NAB) of US$180 billion and bilateral borrowing arrangements of US$340 billion. The IMF has already existing lending commitments of more than US$190 billion.

Increasing the IMF's resources is complicated. Quota resources require the agreement of IMF member countries with an 85 percent majority of the voting power plus the support of the U.S. Congress. The Fifteenth General Review of Quotas, an exercise to determine the adequacy of IMF resources, concluded in February 2020 with no increase in IMF quotas amid a lack of consensus among key member countries. There will be another attempt now scheduled to conclude by December 2023. In January, the IMF agreed on a doubling of the NAB resources to become effective by January 2021 and aims for an extension of its bilateral borrowing arrangements through end-2020.

Table 1. IMF commitments

China has a quota share of 6.4 percent just below Japan and ahead of Germany (Table 1). China's total commitment to the IMF is about US$120 billion. It comprises quota resources of about US$40 billion and commitments under the borrowing arrangements of US$80 billion. This compares with Germany's total commitments of about US$110 billion and Japan's US$170 billion. Given that China's economy is nearly three times the size of Japan and nearly four times the size of Germany, providing more resources seems to be entirely feasible.

The renminbi has been designated by the IMF as a freely usable currency in 2015. IMF borrowing member countries can chose to obtain freely usable currencies they can use to address immediate balance of payments financing needs.1 However, the participation in the extension of IMF credit generally entails drawing on creditor countries' foreign exchange reserves. Currently, the renminbi represents only 2.6 percent of those reserves.

The People's Bank of China could offer resources to the IMF for a new renminbi lending facility. Providing renminbi is near riskless for the PBoC as it can freely issue its own currency. It would allow the PBoC to offer substantial resources enabling the IMF to significantly expand its lending capacity.

China's relatively modest support may rest in its vexed relationship with the IMF. Its quota and henceforth its voting power at the institution is far smaller than it should be. This has been recognised by the IMF for some time and the attempted quota increase under the Fifteenth General Review was to remedy the shortfall and also propose a new formula to calculate quotas. Even under the current quota formula China would have a calculated quota share of 12.9 percent. This would compare to the U.S.' actual quota share of 17.4 percent and its calculated quota share of 14.7 percent. The U.S. remains hesitant to a shift in quotas that would bring its quota share below the critical 15.0 percent—though that would not be required as most quota adjustments will likely need to come from European Union countries including the U.K.—that allows it currently to veto all important IMF decisions including a quota increase.

Borrowing is the only way to increase IMF resources fast. China may resist as its financial contribution would be small relative to its say at the IMF. However, if China were to assume that a quota adjustment will come eventually, it could now demonstrate that not only in economic terms but also in monetary terms, China has become a giant. The renminbi would help add to badly needed new sources of international liquidity.

1 The designation as a freely usable currency plays a central role in the IMF’s financial operations. The IMF stipulates that “for a currency to be determined freely usable, it has to be widely used to make payments for international transactions and widely traded in the principal exchange markets.”