CBDC now at the centre of international economic policy making

26 October 2020

The debate around central bank digital currencies (CBDC) has received a significant boost during the past few weeks. Two issues now seem to dominate: CBDC as an instrument to improve international payments; CBDC as a vehicle to advance the international role of national currencies. The former came to the fore during the IMF Annual Meetings last week elevating CBDC to the core of international economic policy-making. The latter was reaffirmed with the ECB report on a digital euro . CBDC is now set to have significant implications for international payments and for that matter for the financial system as a whole. It is part of a broader debate about greater diversification in payments by mediums, actors and geography.

On 19 October, IMF Managing Director Kristalina Georgieva in a webinar recalled that cross-border payments remain “slow, opaque, costly and inaccessible” for many, while she stressed that CBDC may help address those deficiencies amid its possible role in improving the functioning of the international monetary system. On 13 October, the Financial Stability Board (FSB) offered a timeline for key CBDC development milestones through end-2022. On 9 October, the Bank for International Settlements (BIS) highlighted how CBDC is set to impact international payments and that international considerations will need to be integral to CBDC adoption. On 2 October, the ECB revealed a radical new direction about the role of CBDC in international payments.

The upcoming Italian G20 Presidency is set to continue work on international payments initiated by the Saudi Arabian G20 Presidency with CBDC now likely to be a key focus. Earlier this year, the Central Bank of France announced a series of CBDC experiments—to be followed by a similar project by the Central Banks of Hong Kong and Thailand—to represent the basis for assessing the role of CBDC in international payments.

International transactions are very large and affect all countries. Exports plus imports of goods and services make on average about 100 percent of countries’ annual GDPs. The international investment position of all countries measured by assets is about 200 percent of annual world GDP. Foreign exchange transactions represent about US$6 trillion per day or 2,000 percent of annual world GDP. International payments are therefore critical for the functioning of the international economy.

CBDC is a new medium representing a tokenized format of central bank money. It could be issued and distributed similar to bank notes and circulate next to bank notes and reserves. CBDC exhibits properties akin to bearer instruments in a digital format. The native token properties enable new functionalities and utility of central bank money to meet better actual and future payments needs. CBDC can be held subject to an arms-length relationship with the central bank, akin to bank notes, and used in peer-to-peer transactions irrespective of space and time. As such it can extend access to central bank money while safeguarding essential prudential controls.

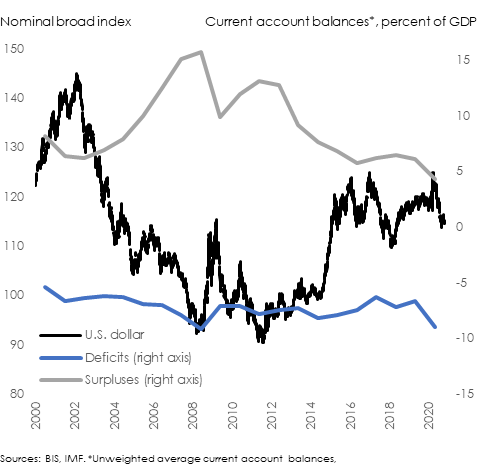

The international monetary system aims to manage foreign exchange liquidity to facilitate orderly international payments conditions. The main actors are the central banks and the IMF with the banking system in its immediate periphery as part of the broader international financial system. Central banks should be able to offer foreign exchange or borrow from the IMF as lender of last resort if liquidity conditions are unduly tight. But, the high concentration of payments being conducted in a narrow set of national currencies, above all the dollar, means the system depends to large extend on the availability and distribution of those currencies. Repeated bouts of exchange rate volatility and persistent high external imbalances are indicative that the system does not work as intended and imposes important external adjustment risks (Figure).

Figure. External imbalances and exchange rate volatility

Central bank money is the safest money in any currency area. It is the preferred settlement medium for large value payment transactions as it does not incur any counterparty, credit and other market risks. However, central bank money is only accessible to resident financial institutions and cannot be used to settle international transactions. For example, if a commercial bank in France sells a French government bond to a bank resident in the Euro Area, it will settle the transaction through the Euro Area’s large value payment system Target 2 and be paid in central bank money and has recourse to central bank liquidity facilities in the event of funding shortfalls. The bank resident in the Euro Area can thus exchange a French government bond for a claim of similar credit quality. If the same government bond is sold in the U.S., it will settle against a euro-denominated deposit balance issued by a bank resident in the U.S. For non-residents of the Euro Area, a French government bond can only be exchanged against a riskier claim on a commercial bank. If the U.S. bank is constrained amid lack of liquidity in euros it may struggle to obtain sufficient funds to settle. Those factors increase risks and costs in international transactions. For settlement in euros and dollars, there is a deep market attenuating those constraints. For smaller currencies those problems can be considerably more severe.

CBDC brings change to international payments if it can address one fundamental problem, that is, the limited access to central bank money in its spatial dimension. The ECB recognises this limitation and has advanced the possibility that non-residents should be able to hold CBDC. This would allow non-residents to settle cross-border and off-shore transactions in central bank money affording a similar quality of and confidence in settlement than to resident institutions. It would approach settlement conditions between domestic and international actors, advance financial integration and may make more attractive the use in particular of smaller currencies.

The ECB now considers CBDC to support a new ambition to advance the use of the euro as an international currency. This follows historically a neutral stance on the international use of the euro. The ECB now sees in greater international use of the euro a decisive advantage granting greater economic autonomy to the Euro Area echoing similar ambitions by the People’s Bank of China and internationalisation of the renminbi. If CBDC can enhance the attractiveness of national currencies, it can bring greater diversity in the use of currencies in international payments, reduce reliance on a small set of currencies and broaden the sources of liquidity for international transactions.

CBDC can enhance the international monetary system through offering greater diversification and operational advantages. The link between CBDC and the international monetary has seemed obvious for some time.1. Now, a new consensus has been emerging among key official actors that CBDC can make a material difference in improving international payments. The benefits would be far reaching. A more diversified, more stable international monetary system would support the international economy in advancing financial and economic integration. Covid-19 has made such attempts all the more urgent. CBDC is now integral to the efforts of improving international monetary relations.

1 See Economics Advisory, e.g.: Financial Innovation and the international monetary system , 14 October 2018; Central bank digital currencies: Reordering international monetary relations , 17 April 2019; Central bank digital currencies and the international monetary system , 25 August 2019; Central bank digital currencies , 10 September 2019; Foreign exchange trading with instant settlement in central bank money , 2 June 2020; 25 June 2020; ECB changes the geography of central bank money , 11 October 2020.