Gold at US$12,000 an ounce?

29 April 2022

The financial sanctions against the Central Bank of Russia, a necessary measure to weaken Russia’s war effort, served as a reminder that access to foreign assets depends on foreign entities. While not all central banks will feel threatened by financial sanctions amid the new geopolitical tensions, with more than US$13 trillion in central bank international reserves, some may want to revisit if existing reserve management practices remain valid. Yesterday, the Gold Council published its gold market trends highlighting strong gold demand amid a combination of the Ukraine war and surging inflation. If gold, traditionally an important international reserve asset, neutral and one that can be held locally, were to play a bigger role in international reserves, it would need a major upheaval in the gold market.

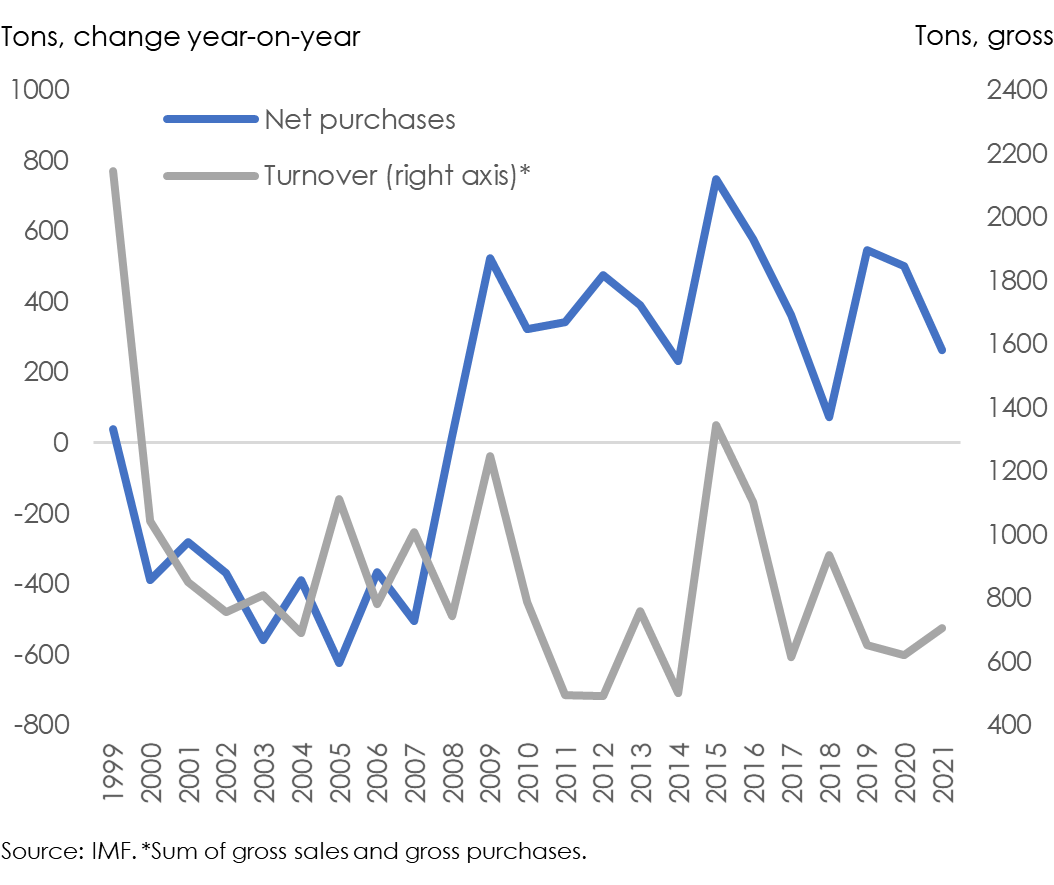

Central banks are one of the biggest holders of gold. In 2021, central banks, including the International Monetary Fund, held about 35100 tons of gold (IMF) or about one fifth of all the gold ever mined (Gold Council). About 3000 tons of gold is being mined every year recently (Statistica) and central banks have bought only relatively little while historical volumes had been higher (Chart).

Chart. Central bank gold purchases

Gold played a key role in central bank reserves. It served as exchange rate anchor, to settle international payments and as principal international reserve asset. Under the IMF par value system (Bretton Woods system), all currencies were fixed to the U.S. dollar while the dollar was fixed to gold at US$35 an ounce. The par value system implied that all currencies were tied to gold. In 1971, the system ended with the suspension of gold convertibility for the dollar. The Second Amendment of the IMF’s Article of Agreement of 1976 put an end to the par value system, allowed countries to choose their exchange rate regimes freely and aimed towards a gradual reduction of the role of gold in the international monetary system and prohibition of any function as a denominator in exchange arrangements.

The importance of gold as an international reserve asset declined subsequently. While in 1950, gold represented about 70 percent of foreign exchange reserves, it represents 13 percent today. But it has recovered from a low of 9.0 percent in 2015. For some big foreign exchange reserve holders, gold has remained small, for example it only makes 3.3 percent of international reserves of China and 3.5 percent of Japan. For the United States and the Euro Area, gold is still big, making 67 percent and 53 percent of total international reserves, respectively.

Gold is illiquid, prices are volatile and it does not pay interest. That is why during the 1990s and 2000s several central banks decided to lower their gold holdings. In 1999, to avoid large price swings when selling important quantities of gold, European central banks agreed to a 5-year gold agreement, followed by similar ones with the last one expired in 2019 to limit the annual amount of gold sales. During the 1960s already, the London gold pool was an earlier attempt to help stabilise gold prices.

Yet, from 1999 through today, central banks were net buyers of gold of 920 tons. The biggest sellers of gold were the central banks of the Euro Area, Switzerland and the United Kingdom with 1664, 1552 and 406 tons and the IMF with 404 tons while the biggest buyers were the central banks of Russia, China and India with 1846, 1555 and 397 tons, respectively.

Gold has two unique advantages. It is neutral and can be self-custodied. The former means gold that while its supply may depend on its price, it is not bound by the vagaries of economic policies of any particular country as is the case with foreign government securities, the main central bank international reserve asset today. The latter implies that it does not depend on foreign custodians and depositaries unlike foreign government securities; central banks keep their gold often with other central banks notably the Federal Reserve and the Bank of England, but several have a preference to store their gold at home.

If China and other large international reserve holders were to decide to increase the share of gold in their portfolios, given the inelastic gold supply, gold prices would have to adjust significantly. Were gold to replace most existing central bank international reserves, it would take a gold price of US$12,000 an ounce or about 6 times the current price of US$1,930 to equate gold holdings to the current value of international reserves. Even at that gold price though, the People’s Bank of China with 1951 tons of gold today would only have US$0.8 trillion or about one quarter of its current international reserves of US$3.4 trillion.

Conditions for gold trading would need to improve significantly to make gold a modern international reserve asset and attain wanted allocations. Digital gold or the issuance of tamper-proof digital representations of gold would allow to overcome many of the limitations of physical gold. It would ensure gold is properly sourced, traced and compliant with international standards. The gold market may need to disrupt itself to facilitate and increase confidence in gold owning, trading and payment to make gold the international reserve asset it could be.