International financial markets: How big is China?

14 May 2022

The financial sanctions by mostly Western countries against Russia, a welcome and needed measure, has served as a reminder that ownership of an external asset does not mean control of an asset. Owning external assets is similar to owning a car but then having to ask the car manufacturer for the key every time the car is driven. China now seems concerned that its external assets may be at risk too. One consequence could be that China will seek to reduce its exposure to Western assets. Calls for a new international financial order may encourage such move however undesirable it would be for the rest of the world. The net effect though would be relatively small.

The control of external assets rests mostly with a small set of institutions typically in the location or place of issuance of the assets. E.g., portfolio assets are controlled by custodians or ultimately domestic and international central securities depositaries (CSDs and ICSDs), sitting on top of the securities chain, that maintain ownership records typically in dematerialised or book-entry form. Securities are issued, deposited and settled in a single issuer-CSD. Non-resident buyers typically maintain indirect access through intermediaries like local agents and global custodians through securities omnibus accounts with the issuer CSD. If CSDs are prevented from transferring a security, it cannot be traded. Domestic instruments are typically issued to a domestic CSD like the U.S. Depositary Trust Corporation and international securities are held by ICSDs like Clearstream and Euroclear.

Total external assets include foreign direct investment, portfolio investment, financial derivatives, other investments and official reserves represent in 2021 about US$190 trillion (IMF) or about 200 percent of world GDP. Claims on non-residents (assets) and liabilities to non-residents (assets held by non-residents) are recorded including valuation changes in the international investment position (IIP) of each country. Western countries--U.S. and Canada, European Economic Area, U.K., Japan, Australia and New Zealand—have assets held by non-residents of US$168 trillion and maintain a net IIP of US$-11 trillion (-19 percent of GDP).

There are US$83 trillion of external portfolio investment held by non-residents. The Euro Area is the largest issuer or obligor of external portfolio assets with 36 percent followed by the U.S. 34 percent, U.K. 7 percent, Japan 5 percent and Canada 4 percent of the total. The largest holders of external portfolio assets including official reserve assets are the Euro Area with 33 percent, U.S. 20 percent, Japan 8 percent, U.K. 5 percent and China 5 percent of the total.

China has a positive IIP of US$2.0 trillion in 2021. Its net IIP had increased by US$0.05 trillion per year during 2011-2021. During that period, it has shifted importantly its international investment position from portfolio towards direct investments. While in 2011, portfolio investments and official reserve assets made up about three quarters of total external assets, in 2021, they made up less than half. Direct investment asset in particular equity, represented 7 percent of total external assets in 2011 and 24 percent in 2021 (SAFE). In 2021, China holds about 5 percent of total external direct investment assets, the fifth largest holder after Germany and before the U.K. Yet, China has maintained a negative net position in direct and portfolio investments. Its positive positions are in other investment in loans and trade credit and in particular in official reserve assets.

The PBoC holds US$3.4 trillion in official reserves, typically debt securities issued by highly rated governments. China keeps about U$1.5 trillion in U.S. securities and remains the second largest holder of U.S. long-dated treasury securities. Since 2011 through 2021, China has been on average a net buyer of official reserves of US$0.05 trillion per year but since 2014 a net seller of US$0.07 trillion per year.

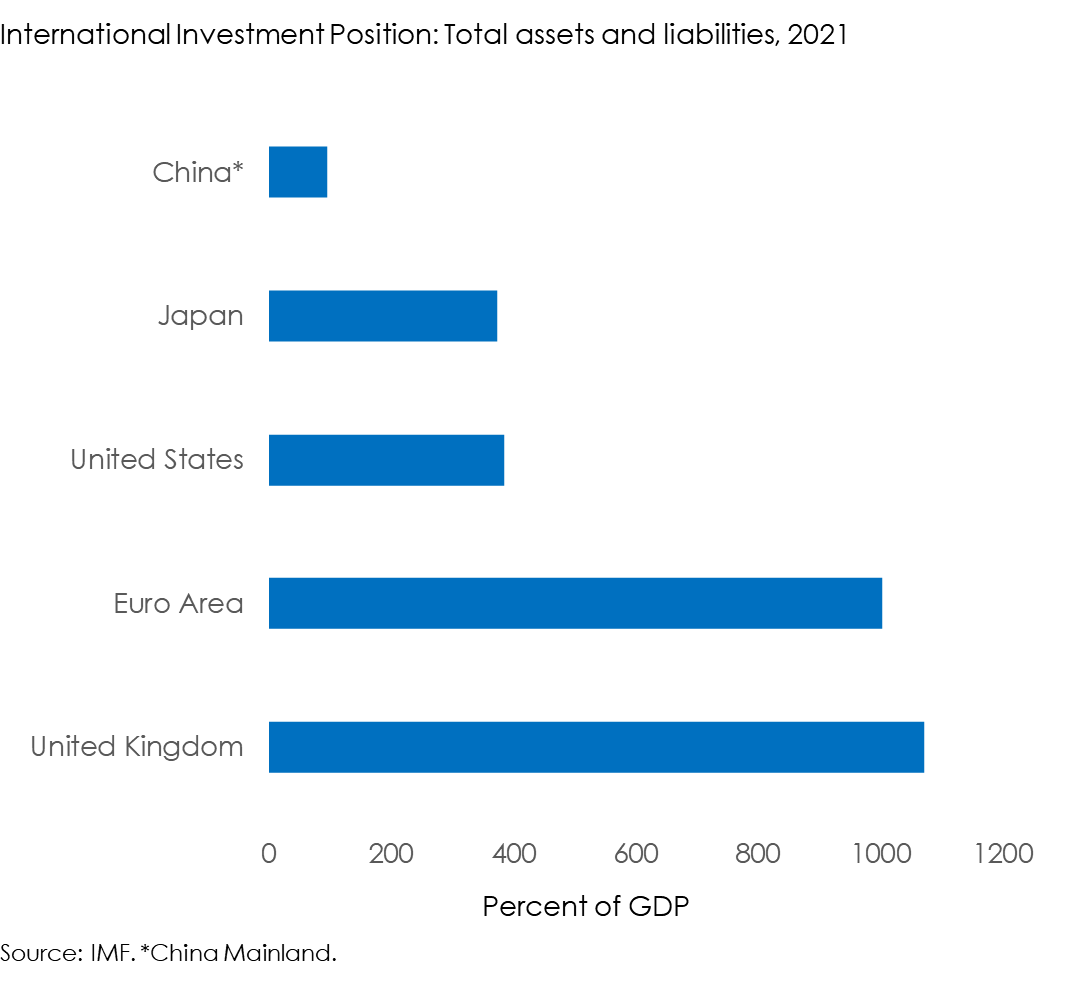

China is not internationally financially integrated. Assets held by non-residents in percent of GDP make up 1070 percent of the U.K., 1000 percent of the Euro Area, 380 percent of the U.S., 370 percent of Japan but only 95 percent of China (Chart).

Chart. Financial openness

China has been critical of the dominance of Western countries in the international financial system for some time. A perceived lack of control over its external assets may become increasingly uncomfortable. Western countries represent about three fifths of world GDP. Yet Western assets make up about nine tenths of total externally held assets. Western countries’ aggregate negative IIP means they owe much more to non-residents than they own abroad depending significantly on other countries for funding. China remains a major net creditor. Its shift towards direct investment seems to show a more permanent external financial commitment. Its positive net IIP also implies it has more to lose than foreigners from an international financial exit. At the same time, China’s lack of financial integration may signal disquiet with existing arrangements. It would make it less vulnerable to change. China’s relatively stable IIP indicates that its net impact on external assets has been limited for some time. If it were to turn away from investing in Western assets, many may not notice the difference.