Currency concentration and cross-border payments

Reinventing Bretton Woods Committee, Dialogue of Continents, 28-29 November 2022, Paris, prepared remarks

Ladies and Gentlemen,

I would like to thank the organisers very much for the invitation to chair this outstanding panel today on cross-border payments. Cross-border payments have for some time been criticised for being slow, opaque and unduly costly. This has been attributed to many factors including the role of correspondent banks, time differences, onerous compliance, long payment chains and limited access. One aspect that has rarely been analysed as a possible cause for persistent cross-border payments deficiencies is the high concentration of currencies used in cross-border payments. It shall be the topic of my brief opening remarks.

Looking at the title of the session—"cross-border payments: A public common good?”—some explanation may be required. The public good notion of cross-border payments rests largely in that the benefits thereof do not only accrue to those dealing in cross-border payments directly. The effects though are not non-rivalrous. Cross-border payments are therefore public though not common goods. The benefits depend in part on which currencies are being used. The importance of a very narrow set of currencies used in cross-border payments seems to suggest that the distribution of benefits is highly uneven. A higher degree of diversification by currency would allow the public good benefits from cross-border payments to approach some common good attributes.

The high concentration of foreign exchange may the fundamental flaw of the current international financial architecture. Few currencies mean a dependence on few countries and hence few institutions with direct access to those currencies. It may also mean the few have little incentives to change a system they dominate.

Foreign exchange turnover is believed to be indicative of the demand for currencies used to conduct cross-border payments. The BIS Triennial Survey 2022 highlights that eight currencies are highlighted by the BIS to represent one currency leg in 96 percent of all foreign exchange transactions. Can international payments problems be meaningfully addressed without a significant increase in international currency diversification? I think not.

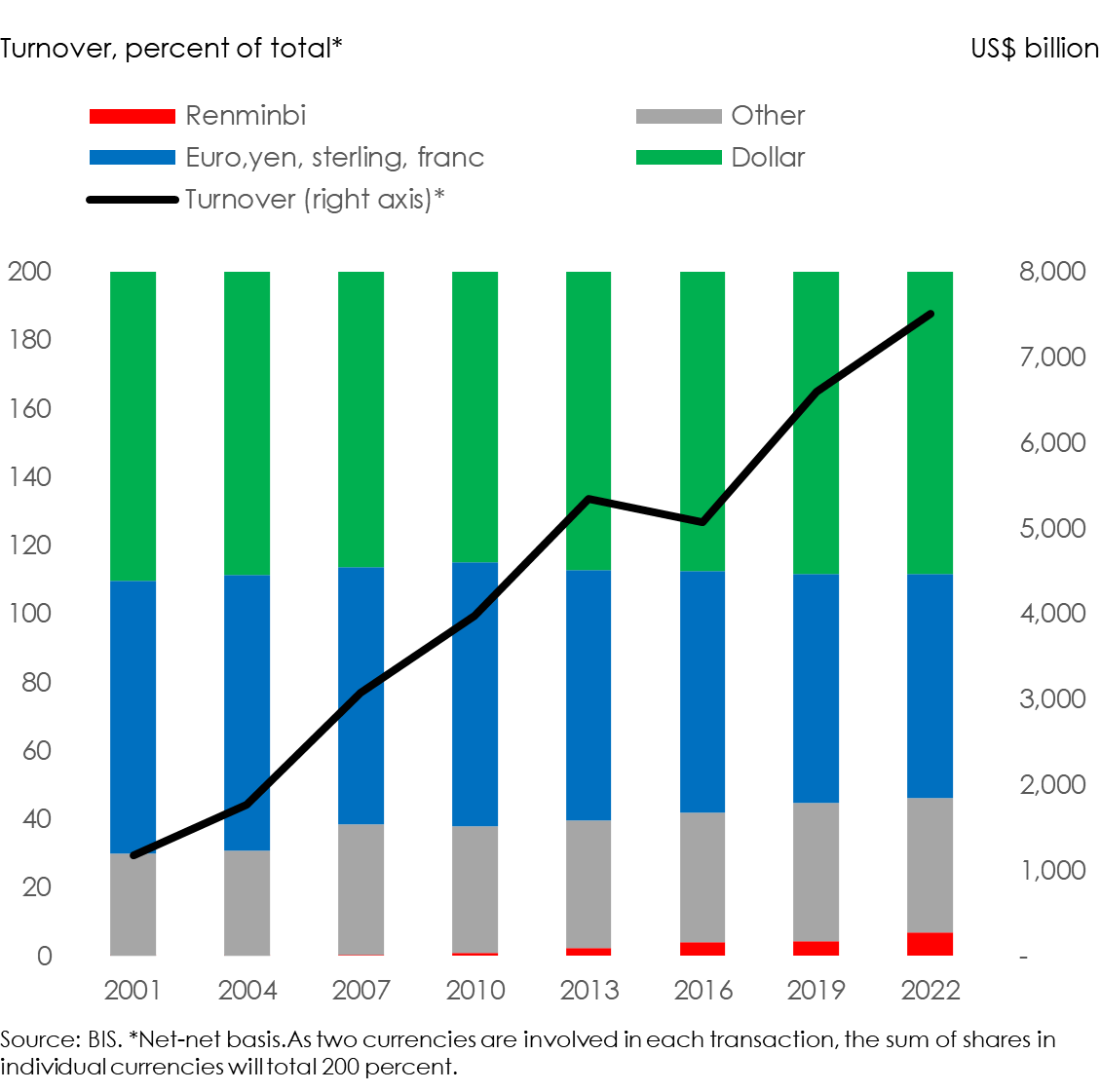

The distribution of currencies used in foreign exchange has hardly changed during the past 20 years (Figure 1). The dollar is one currency leg in about 90 percent of total foreign exchange turnover. The euro represents one leg in 31 percent and together with the yen, sterling and franc, in 65 percent of total foreign exchange turnover. The renminbi makes up 7 percent. The concentration of currencies has remained accompanied by a significant increase in foreign exchange turnover to now US$7.5 trillion per day.

Figure 1. Foreign exchange turnover

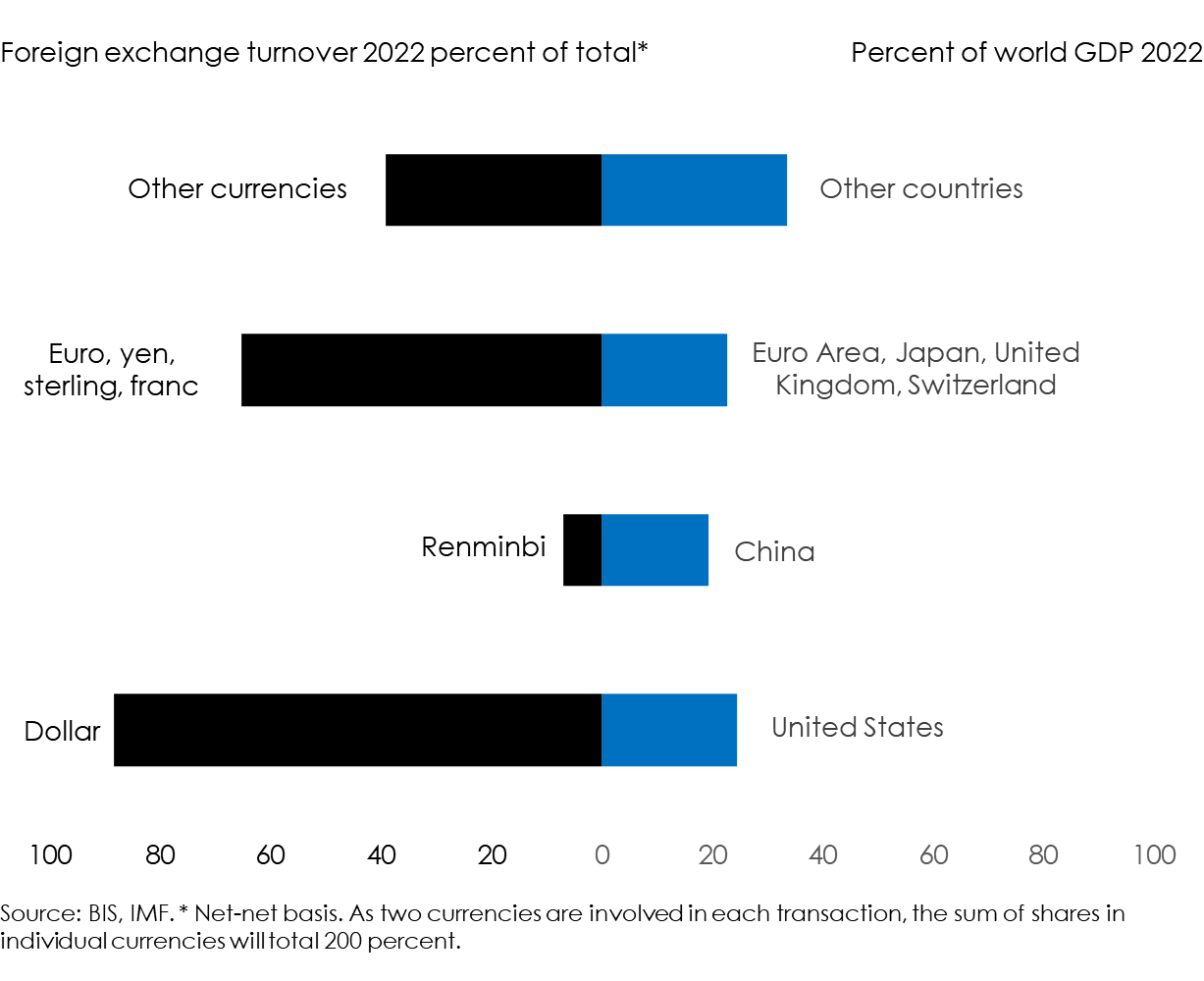

Figure 2. Currencies and output

The international distribution of currencies used in foreign exchange contrasts with the distribution of output today (Figure 2). While there may not be an immediate inter-dependence, the fact that some currencies are used significantly more than others could have important balance of payments and thereby output effects. Strong demand for a particular currency produces strong demand for assets denominated in that currency and may represent an important advantage for those countries whose currencies serve in such role. This is of course Jacques Rueff’s “deficit without tears” by which countries whose currencies are widely used can issue more debt and hence do not incur a balance of payments constraint than countries whose currencies are used only locally.

The overwhelming role of the dollar contrasts with the strong though more measured weight of the U.S. economy. This contrasts with China. While China has grown to represent about one fifth of world output, compared with one quarter for the U.S., use of the renminbi has grown significantly though remains small. Other leading currencies, notably the euro, yen and franc also seem to be used disproportionately to the share of their underlying economies in world output.

The importance of national currencies has long been associated with the depth and importance of the financial markets underlying the currency. It is also about strong network effects and trust in the systems governing these currencies. Yet, other factors, like enhanced functionality and improved access may also be important.

The ECB has reinvigorated the importance of the international role of a national currency. In its 2020 report on a digital euro, the ECB stressed that "a strong international role of the euro is an important factor in reinforcing European economic autonomy." New mediums and new financial market infrastructures may offer additional advantages that may reduce the relative importance of the traditional forces underpinning the demand for currencies. This is also the promise of supporting smaller currencies through central bank digital currencies (CBDC).

To conclude, the distribution of national currencies in cross-border payments remains broadly unchanged against the background of a changing international economy. The effect appears to be centred mostly on the dollar and the renminbi but other leading currencies are also overweighted. It seems difficult to reconcile the convergence of economies by size and persistent differences in the use of their currencies. Herein may lie one of the major challenges for the international economy.