Stable coins' messy communications

11 January 2023

Binance’s announcement of 10 January that its stable coin is actually backed 1:1 is indicative of the difficulties stable coins continue to expose in articulating what they are actually doing. The commitment of a stable coin is similar to a fixed exchange rate, that is, Binance commits to exchange 1 BUSD for 1 USD on demand. Central banks hold foreign exchange reserves to signal that they can uphold convertibility [until they cannot]. They do not explain how they do it nor is there any indication that the commitment spans all national currency denominated liabilities. Stable coin issuers should look at and learn more from central banks.

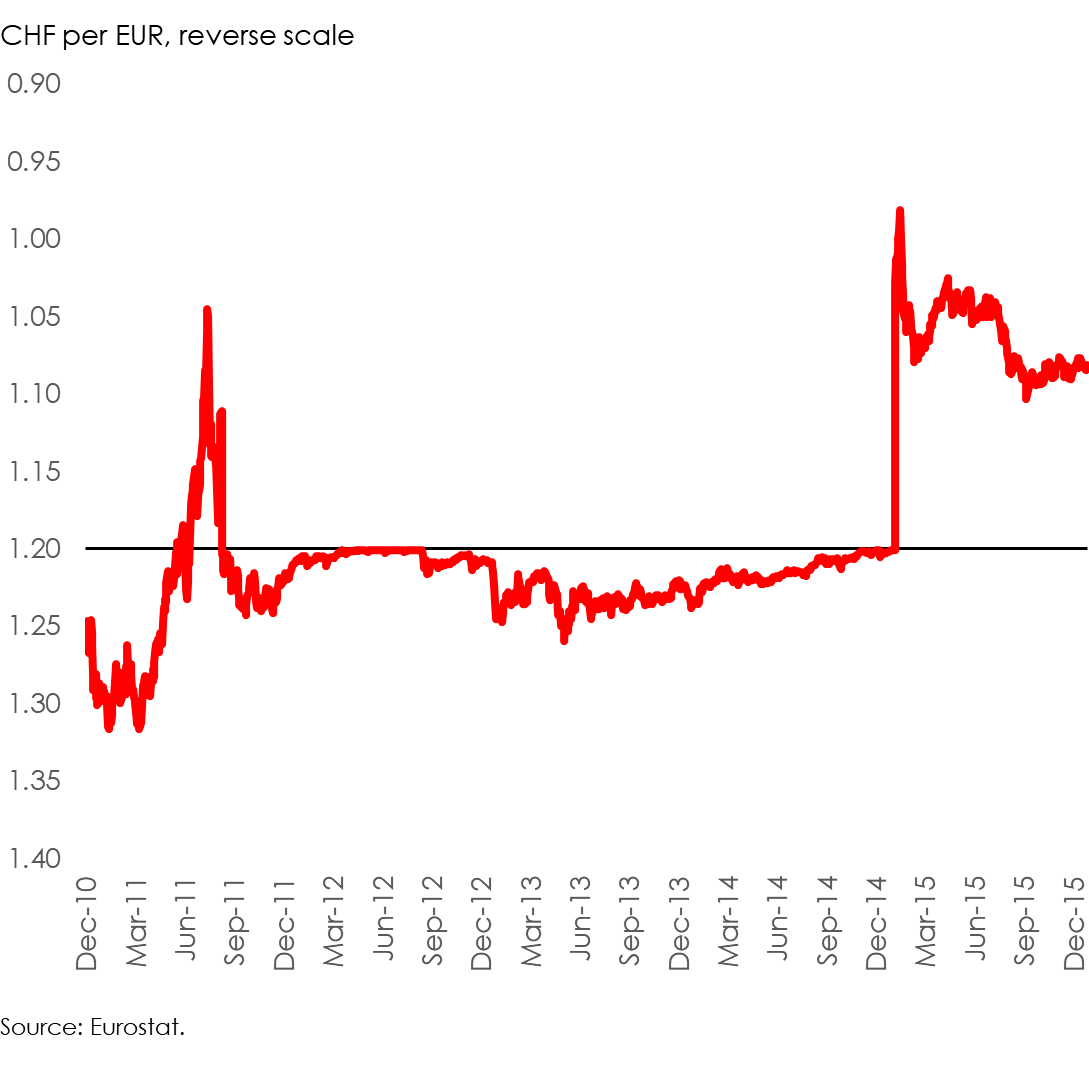

The Swiss National Bank announced on 6 September 2011: “With immediate effect, [the SNB] will no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20. The SNB will enforce this minimum rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities.” Now of course, it is the SNB making the announcement. Ideally, it is enough for a central bank to announce its target without actually needing to intervene. This was not quite the case for the SNB and it made net foreign exchange purchases to weaken the franc until it abandoned the peg on 15 January 2015 of around CHF207 billion (USD209 billion). The SNB offers a high-level overview of its foreign exchange reserve assets by currency, investment categories and credit rating (for fixed income assets). That’s it.

Figure 1. EUR CHF exchange rate

When the SNB abandoned the peg, the franc appreciated from CHF1.20 to CHF0.97 to the euro. This caused of course huge losses for EUR holders. The important lesson here is, central banks can fix exchange rate as they like. If they no longer want to or can fix, they abandon the peg or are forced to do so. Naturally, central banks differ greatly in their credibility to fix in the first place. A fixed exchange rate is “just” a policy commitment.

Binance was at pain to explain: “Recent news reports have shone a light on Binance-Peg BUSD and how it doesn’t always appear to have been completely backed by BUSD issued by Paxos. In short: Binance has always rebalanced or updated the assets in the pegged addresses periodically, not in real time. We now rebalance much more frequently to ensure it’s always 1:1 backed.” The very idea that the BUSD has to be always backed 1:1 in itself is problematic. Naturally, this matters only if there is a complete run on BUSD which is very unlikely to happen (there had been a few stress scenarios recently to support this view). Holders of BUSD have therefore no reason to believe that a backing of less than 1:1 in any ways impairs Binance’s ability to redeem BUSD at par. There would have to be a considerable decline in the foreign exchange reserves of Binance relative to BUSD coins outstanding, for it to have a material impact on convertibility.

Binance states that it is backed by U.S. banks although it is not clear what that means since its reserves are held in U.S. treasury debt and repos which would offer a backing far superior to banks. It also states that BUSD reserves are regularly audited and makes available monthly BUSD breakdowns.

The level of reserves matters. When reserves run out, pegs become unsustainable. This was the case, e.g., in the sterling crisis of September 1992 when the market no longer believed the Bank of England had the firepower, amid massive foreign exchange sale, to sustain the ERM floor of DEM2.78, sterling crashed through the floor and was forced to float.

Stable coin issuer need to learn to think and articulate their policies more like central banks. Many central banks have of course a poor record of maintaining fixed exchange rates—though their constraints are far more severe than for stable coin issuers—so the learning should be highly selective. The art is to guide users’ expectations over the medium term that the policy of safeguarding the peg is robust. This includes information about the level of reserves that typically for emerging markets central banks is reported on a daily basis. There needs to be regular communications to outline the importance of the stable coin and role to sustain demand for it. Audit reports, explanations about rebalancing, etc. do not matter.

Stable coins offer an important monetary function by serving as native payment instruments denominated in national currencies on DLT-based financial market infrastructures. They may have a good chance to become dominant mediums with the adoption of DLT infrastructures. Naturally new issuers will emerge, many of which will be established payment system players. Today’s stable coin issuer need to ensure they can remain competitive. Effective communications and transparency will be among the essential success factors.